ABB manufactures and sells electrification, industrial automation, and robotics and motion products for customers in utilities, industry and transport, and infrastructure worldwide. The company started in 1883 and based in Zurich, Switzerland.

Investment Thesis

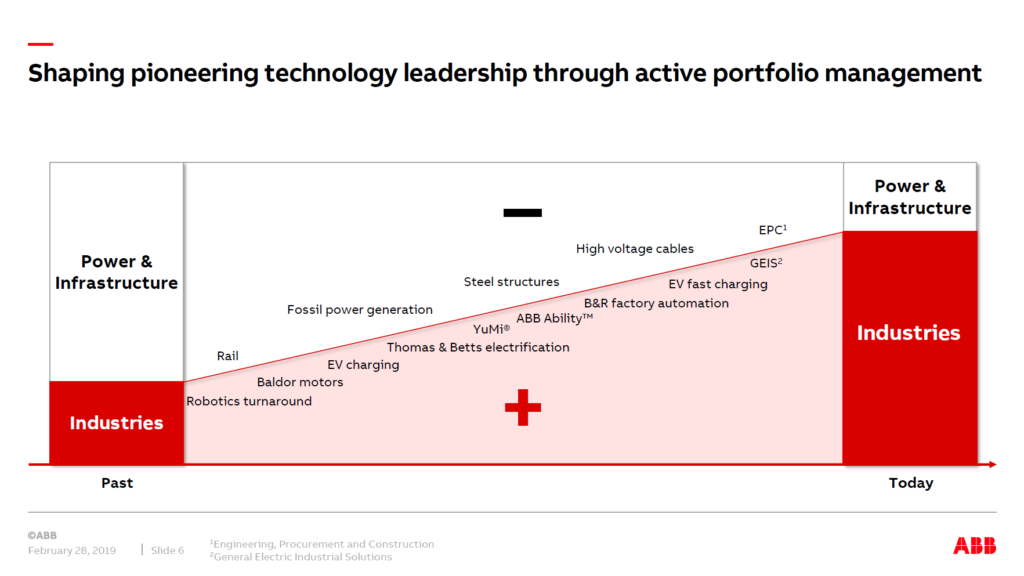

ABB is undergoing a business transformation that should increase sales growth and earnings, while also giving the company the ability to return significant amounts of cash back to shareholders. ABB’s shares are down approx. 25% from their early 2018 high to around $21.80. ABB is selling its utility-infrastructure and power-grid business to Hitachi in a deal that values the unit at $11 billion. “Rail assets are gone, power generation is gone, now power grid is gone,” former CEO Ulrich Spiesshofer said when reflecting on the company’s transformation. The company’s goal is to transform ABB into a leaner and less volatile operator that will benefit from several important secular growth drivers: automation, robotics, and energy management. Looking ahead, ABB’s focus is all about digital transformation. In other words, ABB seeks to capitalize on industrial trends such as automation and big data—feeding factory information into the cloud to improve plant uptime and reduce maintenance expenses.

In some respects, ABB’s digital transformation will make the company more like Rockwell Automation, which makes software and hardware that control processing facilities such as chemicals plants and factory floors. Rockwell typically trades at a premium to ABB. Rockwell has historically earned a higher valuation multiple because its business grew faster than ABB’s business and generated more attractive profit margins than the legacy ABB portfolio. When the first stage of the grid sale is complete, ABB will receive $7.6 billion in cash. Management plans to return that cash to shareholders through a share buyback. At current prices, those proceeds would fund the purchase of up to 20% of the existing shares outstanding.

After disposing of the grid business and shrinking the capital base, ABB could earn $1.60 per share in 2020 and possibly $2.00 per share by 2022. If ABB shares were to trade more like Rockwell’s, the stock could reach $30. ABB pays an annual dividend of $0.78 and currently yields 3.5%. Additionally, ABB’s net debt is low, and the company does not have financial subsidiaries that extend loans for capital equipment. We appreciate that the company now understands that one must be the number one or number two competitor in a market to generate the necessary returns on invested capital. After exiting the power business, ABB will be number one in electric motors and process automation, and number two in electrification products and robots. Wall Street remains skeptical. Global industrial production has been slowing, but the future of production will incorporate a wave of new technology. ABB provides investors a conservative way to participate in the changing manufacturing landscape. We estimate intrinsic value of roughly (c.) $27 per share and believe an investment here offers an adequate margin of safety for investors with attractive yield.

Business Description

The ABB Group was formed in 1988 through a merger between Asea AB and BBC Brown Boveri AG. Initially founded in 1883, Asea AB was a major participant in the introduction of electricity into Swedish homes and businesses and in the development of Sweden’s railway network. In the 1940s and 1950s, Asea AB expanded into the power, mining and steel industries. Brown Boveri and Cie (later renamed BBC Brown Boveri AG) was formed in Switzerland in 1891 and initially specialized in power generation and turbines. In the early to mid‑1900s, it expanded its operations throughout Europe and broadened its business operations to include a wide range of electrical engineering activities. In January 1988, Asea AB and BBC Brown Boveri AG each contributed almost all of their businesses to the newly formed ABB Asea Brown Boveri Ltd, of which they each owned 50 percent. In 1996, Asea AB was renamed ABB AB and BBC Brown Boveri AG was renamed ABB AG.

In February 1999, the ABB Group announced a group reconfiguration designed to establish a single parent holding company and a single class of shares. ABB Ltd was incorporated on March 5, 1999, under the laws of Switzerland. In June 1999, ABB Ltd became the holding company for the entire ABB Group. ABB Ltd accomplished this task by issuing shares to the shareholders of ABB AG and ABB AB, the two companies that formerly owned the ABB Group. The ABB Ltd shares were exchanged for the shares of those two companies, which, because of the share exchange and certain related transactions, became wholly‑owned subsidiaries of ABB Ltd. ABB Ltd shares are currently listed on the SIX Swiss Exchange, the NASDAQ OMX Stockholm Exchange and the New York Stock Exchange.

ABB’s sustainable competitive advantage comes from the high switching costs customers face, because ABB’s top market supplier position embeds its products within its customers’ processes. The company’s industrial automation and robotics and motion divisions are ABB’s strongest businesses. Both divisions integrate into the customer’s processes, with a high degree of technical skill, thereby creating reinforcing and sustaining ABB’s competitive advantage. At the company’s core, both businesses run machines and ensure efficiencies, as well as other operational performance metrics, through control systems. These processes involve a system of motors, sensors, and microprocessors that power equipment and simultaneously send back critical data for ABB’s control software. Measurements of temperature, vibration, power, and other elements enable the software to predict maintenance needs, as well as changes needed to meet performance requirements.

Over the past few years, ABB has painfully reoriented its businesses to compete in the fast-changing digital industries. ABB is now focusing their portfolio on digital industries and will divest their Power Grids business to Hitachi in 2020, in order to simplify their business model and corporate structure, as well as focus on their remaining core businesses. The company’s decision to divest the Power Grids business reflects the growing difference in customer needs between the large-scale infrastructure, utility and industry sectors. The utility customer base is consolidating, and ABB sees a re-convergence of power generation and power grids. Increasing project sizes and changes in the commercial pattern of utility customers also often require suppliers like ABB to provide access to project financing. Having turned around Power Grids over the past few years, ABB decided to divest the business. Initially, ABB will retain a minority shareholding in a joint venture with Hitachi.

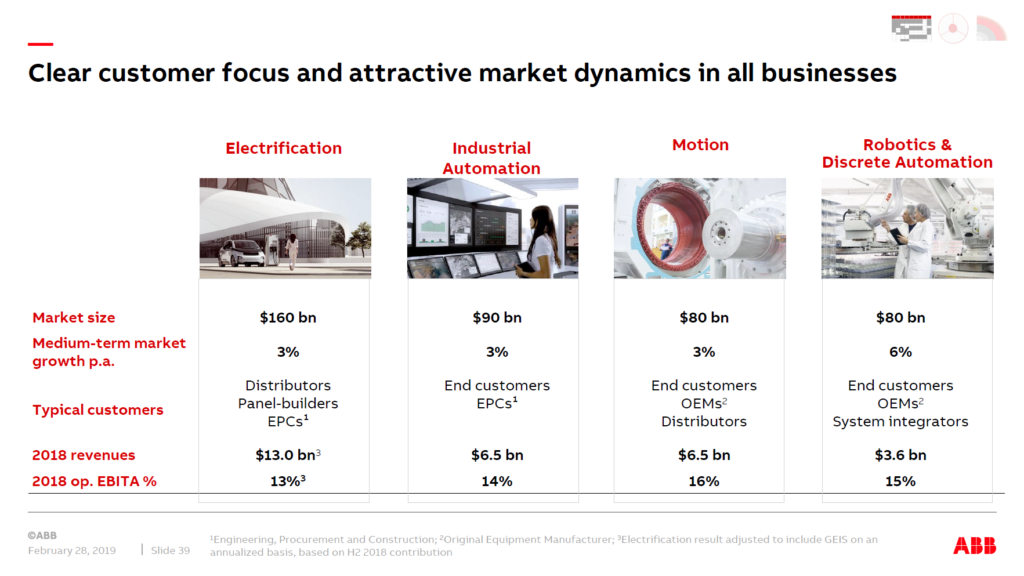

The remaining ABB will cover electrification, automation, robotics and digitalization, with the goal of positioning the company as a technology leader in digital industries. With their four remaining businesses, ABB will address a market worth more than $410 billion and growing by 3.5% to 4% percent per annum. By 2025, this market is expected to expand by $140 billion to $550 billion.

The Electrification business offers a portfolio of products, digital solutions and services, from substation to socket. In 2018, ABB strengthened the business’ number two market position through the acquisition of GE Industrial Solutions, GE’s global electrification solutions business, which will contribute to the company’s presence in North America. The Electrification business has strong exposure to rapidly growing customer segments, including e-mobility, data centers and smart buildings.

The Industrial Automation business offers a range of solutions for process and hybrid industries, including industry-specific integrated automation, electrification and digital solutions, control technologies, software and advanced services, as well as measurement and analytics, marine and turbocharging offerings. Industrial Automation is number two in the market globally.

ABB’s Motion business provides customers with a range of electrical motors, generators, drives and services, as well as integrated digital powertrain solutions. Motion is the number one player in the market globally.

The company’s Robotics & Discrete Automation business combines ABB’s machine and factory automation solutions with a comprehensive robotics solutions and applications suite. The business is number two globally, with a number one position in robotics in the critically important, high-growth Chinese market, where ABB is expanding its production capacity by investing in a new robotics factory in Shanghai.

ABB has an enviable base of robotics and automation customers that puts it in a solid position for Industry 4.0, or Industrial Internet of Things. Both its robotics and industrial controller products, which are used to program equipment, have leading market share and enjoy loyal customer bases that would be difficult for competitors to capture. ABB’s electrification products division offers some overlap with other customer segments, such as process industries, that could prove useful in cross-selling the automation portfolio. However, growing demand from Industry 4.0 has meant that ABB and its close competitors have had to refresh their product offerings, acquiring or developing in-house industrial automation components and software.

ABB does have several areas where we have concerns. The company has been slow to refresh its product offering and has had to turn to second-best choices. With the acquisition of programmable logic controller supplier B&R in 2017, ABB was hoping to gain share in hybrid automation solutions, which combine distributed control systems and programmable logic controllers (PLCs). A programmable controller is an industrial digital computer which has been adapted for the control of manufacturing processes, such as assembly lines, or robotic devices, or any activity that requires high reliability control and ease of programming and process fault diagnosis. However, customers using controllers do not change suppliers readily, making it tough for a company like B&R to expand market share, even with the weight of ABB behind it. ABB’s software strategy lags that of competitors like Siemens and Schneider. ABB has a hybrid strategy for its Industry 4.0 software, offering most of its equipment productivity and maintenance optimization software from its own developed software portfolio, while for design and simulation software, it has a partnership with Dassault Systemes. Without the partnership, ABB would have had to develop the software in house or find an acquisition target.

Despite these concerns, ABB still retains an enormous base of installed robots and controller products which tend to be very long-life and are complimented by a sticky customer base. Barriers to entry are high for its products and owing to the risk aversion of the company’s customers, much of ABB’s new revenue comes from projects where client only considers a few suppliers.

Valuation

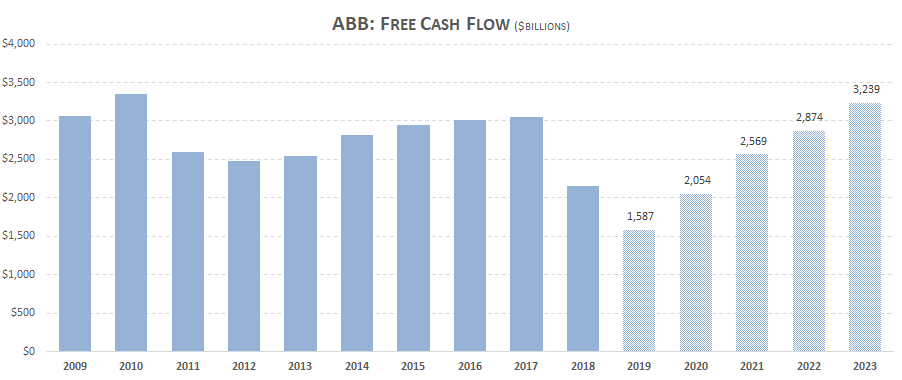

ABB maintains a conservative balance sheet, with net debt to cash flow from operations currently at a multiple of one or below for the past decade. The company generates about $2.2 billion annual in free cash flow, so in theory it could pay off its roughly $6.5 billion in long term debt in less than three years.

ABB is the number two robotics supplier globally and the number one in China—important as the country is still underpenetrated relative to markets like Germany and Japan. The robotics division has the potential to grow at its revenue at compound annual rates of growth more than 6%; however, should ABB tap into new under penetrated sectors for robotics, outside of autos and electronics, we believe the company could achieve much higher growth levels. ABB has made some strides in expanding its target markets, but we see potential for the company to do more. In addition, we see potential for margins to improve in the automation portfolio, where operating margins trail peers like Rockwell and Siemens. We believe that ABB’s competitors have done a better job of developing their respective industrial automation software businesses, which are growing faster and offer higher margins relative to automation hardware. ABB has yet to reach its potential and constitutes potential further upside that we do not model in our assumptions.

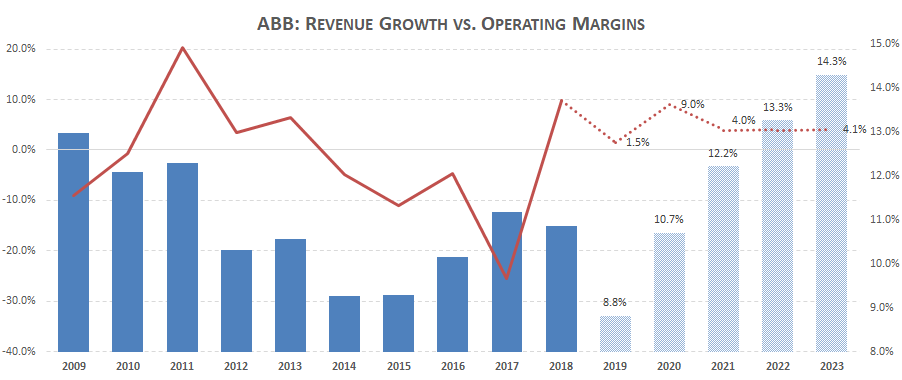

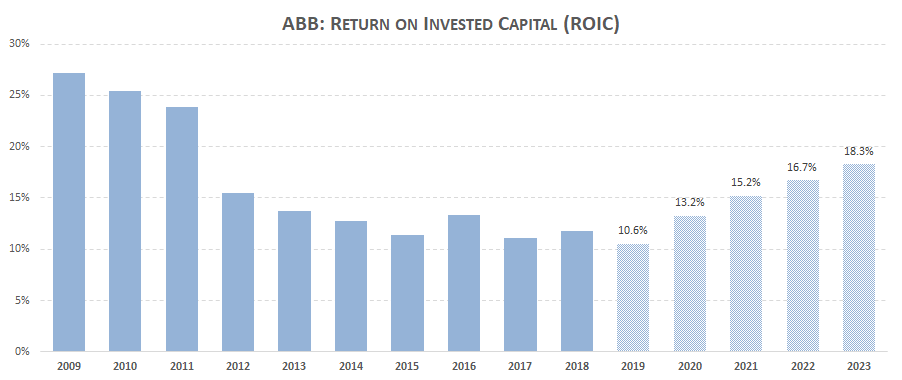

Our fair value estimate is c. $27 per share. Our fair value estimate incorporates the pending sale of the power grids division at the valuation that Hitachi has agreed to pay ABB. Through to 2023, we forecast an average 4% revenue compound annual growth rate with operating margins improving from 8.8% in 2019 to 14.3% in 2023. We expect the robotics and industrial automation divisions to generate high single digit revenue growth while electrification products should generate only low single digit revenue growth. This level of revenue growth, coupled with material improvements in operating margins, should generate very attractive returns on invested capital over our model forecast period.

Management states that the company’s capital allocation priorities are to fund organic growth, research and development, capital expenditures and value-creating acquisitions. Management also notes that they remain committed to delivering a rising, sustainable dividend – the Board of Directors proposed a dividend of CHF 0.80 per share to shareholders at the Annual General Meeting on May 2. Following the divestment of 80.1% of Power Grids, ABB intends to quickly return the net cash proceeds of $7.6–7.8 billion to shareholders. We believe that the company will use the net proceeds to repurchase shares but we have not modelled that in our assumptions. Improving free cash flows, in addition to the Hitachi sale net proceeds, provide management ample opportunity to implement their capital allocation priorities.

Risk to Investment

Non-core acquisitions and cybersecurity are two key risks to ABB’s business. The company has a long history as a serial acquirer and at times has veered off road from its core business. However, the company’s 2017 acquisition of B&R and more recent acquisition of GE’s low-voltage business as strategic and do not anticipate that the new management team, in place since 2013, should make significant non-core acquisitions in the near term.

ABB is moving more of its equipment online, with customers looking to ABB to take live measurements to improve algorithms running equipment and predict maintenance needs. However, this also leaves the company open to increased risk of a major cyber attack and risk to its reputation as a reliable partner. The utilities segment is one customer segment that has not put its equipment online for this very reason.