Thesis Summary

• BJ has been one of the largest beneficiaries of the COVID driven stay-at-home boom and the deurbanization trend.

o While much of this sales gain is likely to prove sustainable due to food inflation, a regression to the mean seems likely as tailwinds from trip consolidation and consumers working from home likely ease in a post-COVID world.

• Perennial share donor prior to the pandemic

o Prior to the pandemic, BJ’s was a clear share donor and the company’s SSS ex. gas were negative in every year from 2013-2017. SSS only inflected to a positive LSD% rate in 2018-2019 when Wal-Mart moved to close several Sam’s Club stores in BJ’s core geographies

o BJ faces intense competition in what is historically a low growth industry

• An important point here is that unless sales trends reaccelerate, the upside case in BJ (discussed below) is already priced in.

o On Street numbers, BJ is already trading at peak multiple on what are likely peak earnings.

o BJ is also trading nearly in-line with best-in-class staples retailer DG despite lacking the historical growth track record that DG has

• While bulls point out that BJ’s unit growth is set to accelerate to 4-5% next year (in-line with best-in-class player DG), we are skeptical that this will be successful as BJ does not have a track record of successfully expanding outside of its core East Coast geography

• BJ is overearning on fuel margins that are significantly elevated relative to history. We estimate that a regression to the mean in fuel profits in 2023 will represent a headwind to EBIT/EBITDA of nearly $90m on a base of $679m of 2022 EBIT i.e. a 13% headwind.

Valuation and Returns

NTM P/E: BJ historically traded at 17x NTM Street EPS vs. current 19x Multiple

EV/NTM EBITDA: BJ historically traded for ~9x vs. current 10.6x multiple

BJ is currently trading nearly in-line with best-in-class staples retailers DG and WMT despite having a historical financial profile that more closely resembles a conventional grocer.

Source: Bloomberg

Considering the significant downside to Street 2023 EPS numbers from potential fuel margin regression to the mean, and the potential for BJ’s to trade back towards it’s own historical average P/E multiple, we believe there is 28% downside to BJ shares ($54 PT) based on 17x our 2023 EPS of $3.20

Company Overview

• BJ’s is a Warehouse Club chain which primarily sells groceries (71% of sales), general merchandise (14% of sales), and gas & ancillary (15% of sales)

o Groceries consist of meat, produce, dairy, bakery, deli and frozen products, packaged foods, beverages, detergents, disinfectants, paper products, beauty care, adult and baby care and pet foods

o General merchandise consists of optical, tires, small appliances, televisions, electronics, seasonal goods, gift cards, and apparel

Note that General Merch is only 14% of BJ’s sales vs. 32% for COST – this is evidence that BJ’s lacks the ‘treasure hunt’ experience that COST provides for shopppers

o Ancillary services include optical, tire installation, travel services, cell phone kiosks, and a propane tank filling service

• Company claims to price in-line with club competitors and at a 25% discount to conventional grocery stores

• BJ’s had 229 clubs as of the end of 2Q22 with the company’s presence concentrated in the Northeast and Florida though newer markets for BJ include Michigan and other parts of the Southeastern US

• Company’s core value proposition is selling groceries at a 25% discount relative to conventional grocers.

• Company caters to a lower income customer on average relative to COST and Sam’s Club:

o “Under SNAP, we are currently authorized to accept EBT payments, or food stamps, at our clubs as tender for eligible items, and payments via EBT accounted for 4% to 7% of our net sales over the last five fiscal years.” – 2020 10-K

o A JPM note from early 2022 estimated that SNAP had ramped from 4% of sales in 2019 to 7% in 2020 to 11% in 2021

• Leonard Green and CVC acquired BJ’s in 2011. BJ’s then IPO’d in June 2018 at $17 per share. Both Leonard Green and CVC have since completely exited their BJ’s positions at various prices

BJ Quick Financial Overview:

BJ’s was Historically a Share Donor in an Intensely Competitive Industry

And the rapid expansion of hard discounters Aldi and Lidl in BJ’s core geographies represents an existential threat to BJ’s business.

And Targeting BJ’s Core East Coast Geography

An academic study by UNC Business School of Lidl’s entry into Long Island illustrates the impact on industry profit pools:

Aldi, another German Hard Discounter, has also been rapidly expanding its US footprint:

And the UK offers a cautionary tale on the discounters’ ability to decimate the grocery industry’s profit pool:

Traditional competitor COST has also been a significant headwind to BJ’s sales growth historically

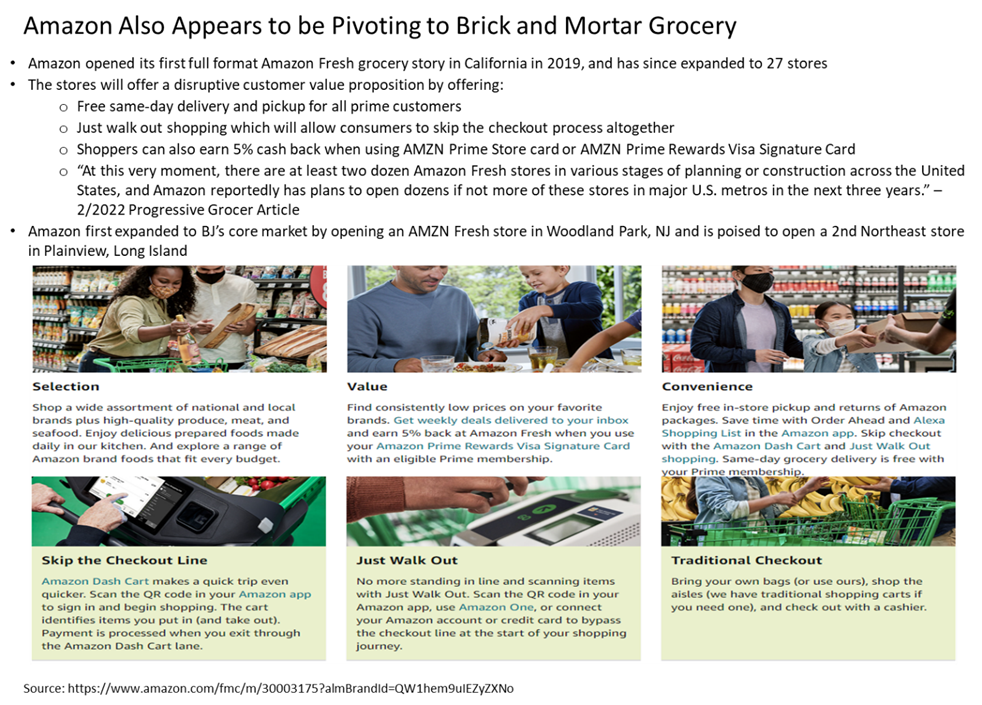

And AMZN is also pivoting its focus to brick-and-mortar grocery:

And while Food Inflation has benefited all industry players, there are early signs that food inflation may be peaking:

While still elevated, commodities are now significantly below recent peak levels.

We believe that when food inflation ultimately levels off, investors attention will return to the harsh competitive environment for US grocers described in the prior section.

BJ’s does not have a Successful Track Record of Unit Growth and Management Expectations for a Permanent Acceleration to 4-5% Unit Growth May Prove Unrealistic

BJ’s store productivity is inflated relative to trend. While some component of this should prove to be sticky due to Food Inflation, the continued return to offices in BJ’s core Northeast geography should cause continued mean reversion going forward.

While Office Attendance in BJ’s Core NY Metro Geography has begun to recover again post-Labor Day, it remains significantly below pre-COVID levels suggesting there is further room for store productivity to mean revert. The below chart shows attendance as a percent of pre-pandemic levels.

Source: Kastle Systems via Bloomberg

BJ’s Should Struggle to Grow EBIT/EPS in 2023 as it Laps Outsized Fuel Margins

Fuel Margins are dramatically inflated relative to historical trends.

Source: OPIS, Street Research

And have been a significant tailwind to BJ’s EBIT growth in 2022 which we expect to unwind in 2023

Risks

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise hold a material investment in the issuer's securities.

We believe that BJ's will be forced to guide 2023 earnings meaningfully below Street with when the company reports Q3 2022 or Q4 2022 EPS results.