| 2021 | 2022 | ||||||

| Price: | 1.54 | EPS | 0 | 0 | |||

| Shares Out. (in M): | 271 | P/E | 0 | 0 | |||

| Market Cap (in $M): | 510 | P/FCF | 0 | 0 | |||

| Net Debt (in $M): | 0 | EBIT | 0 | 0 | |||

| TEV (in $M): | 0 | TEV/EBIT | 0 | 0 | |||

Sign up for free guest access to view investment idea with a 45 days delay.

- Arbitrage

- None found

Description

Thesis summary: This is the fattest relative value pitch I have seen in my entire career. The German listed shares of Haier Smart Home ('HSH', 690D in Frankfurt, hereafter 'D-shares'), one of the world's largest appliance manufacturers, trade at an absurd 55% discount to the HK-listed shares, despite being identical in terms of economic exposure (minus the currency denomination), with equal dividend and voting rights. Whilst they are less liquid than the HK line, liquidity is reasonable ($10mm+ per day recently); the junior listing is in another developed market and good jurisdiction (Germany), and all key disclosures are in English. And while the shares do not appear to be fungible right now, there is a clear legal pathway to fungibility outlined in the recent HK-listing prospectus; moreover there are idiosyncratic reasons to expect fungibility to be allowed at some point in the medium-term.

But even if the shares NEVER become fungible, this spread for economically-identical, differently-listed exposures is by far the widest in the developed world (if not the whole world): the only similar securities are BHP (~16% discount for the UK line) and RIO (15% discount), and even these spreads only peaked at 30% in the teeth of the pandemic in March. The Haier Group, HSH's parent company, appears to recognize the insanity of this discount because it announced - on December 31st - a plan to buy back about up to 60% of the D-shares they don't already own - that is, roughly half of all D-shares outstanding.

This opportunity exists because the D-shares were an orphaned security for most of the past two years (after the D-share listing failed back in 2018); because the HK listing only happened two days before Christmas, and the sell/buy-side in Asia is barely aware of it; because the sell-side is not cognizant these D-shares exist (or that they are economically identical to the H-shares, let alone potentially fungible); and because it appears some legacy Chinese shareholders of the D-shares (holders since the IPO and underwater for much of that time) are taking profits now that the stock is above IPO price (1.05).

I expect the spread to tighten to <15% in the next few months, perhaps even tighter than that, driven by a combination of:

1) Fundamental switching by exchange-agnostic fundamental investors. The HK free float is ~$8bn today. If only 1-2% of this value switches to the German line, it would close the spread significantly (since the entire German line free float is ~$300mm);

2) Relative value accounts: this is by far the widest 'dirty arb' of this kind, that I can find, in the developed world. It is actionable, liquid, and funds itself. There is also upside from fungibility in the future. Once RV accounts know about it and understand it, I think they will pile in;

3) HSH's parent co has announced a plan to acquire up to 2% of the entire company (less 57mm shares they alrady bought) - entirely through the D-shares. Should they execute even partially (they have six months to do so), the spread should close significantly if not all the way.

If the spread tightened to 15%, holding the HK line constant, you would see an 86% return in the German line (you can run this outright if you like, but at these relative levels I prefer the spread).

Today, you can buy the D-shares at 1.54 and sell the exact same economic exposure (through the HK line) at 3.37. The HK line is incredibly liquid ($100-$150mm/day) and an easy borrow; the D-shares are less liquid but still workable ($10mm/day, maybe $5mm/day normalized). This spread is positive carry (given the funding differential in selling HKD and buying EUR; the dividend differential pays for the borrow cost) as well. As such this should be actionable for most all accounts.

Background on the D-share listing

Let's start at the beginning. Haier Smart Home was formerly known as Qingdao Haier, and has been a large, growing, global white goods manufacturer for many years. It first listed on the Shanghai stock exchange in 1993 and was only domestically listed until 2018, when it was the first - and only - Chinese company to pursue a special German listing on the nascent 'D-share' market. You can read about the project here, but essentially this was something of a public relations exercise to attempt to bring Chinese and German capital markets, and economies, closer together through the dual listing of a couple of Chinese national champions.

In the end, the move was a flop: Haier found no local demand, and only sold 271mm shares at 1.05 EUR (originally they wanted to sell 470mm), with Chinese SoEs taking down 40-50% of the shares sold (and most of the rest sitting on bank dealer desks, for years). Predictably, the shares traded poorly, spending most of the next 2+ years languishing below their issue price, with liquidity drying up as well. During this time the A-shares - the Shanghai listed shares - remained trading, and at a massive premium, but since the D-shares were not fungible with the A-shares, there was no reason for the discount to close. As it was, the Haier D-shares remained something of a stranded instrument.

The H-share listing - a game changer for the D-shares

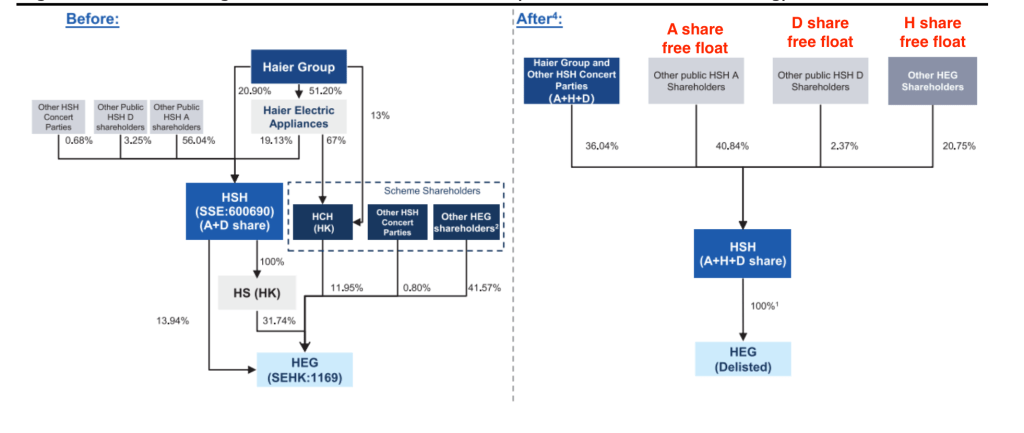

This all changed a few days ago with Haier's relisting in Hong Kong. One of Haier's operating subsidiaries, Haier Electronics (~46% owned by the parent) had a legacy listing in HK, but earlier this year, in an effort to streamline a very complex corporate structure, Haier decided to issue parent co (that is, Haier Smart Home) shares to its minority shareholders, to absorb the sub and simultaneously relist the parent co in HK. This was achieved on December 23, with the pre- and post-restructure org chart looking like this:

At this point, HSH has become a 'tri-listed' company (Shanghai, Frankfurt, HK), with the D-shares still representing a very small part of the overall capital structure. Still, the HK relisting was crucial for D-share shareholders (that's us), in a couple of different ways.

Firstly, the HK relisting prospectus unequivocally proves the equal economic rights of D-shareholders with that of all other shareholders. This is important, because when the sole other listing was onshore China, even if economic parity was stated in the original D-share docs nevertheless there would always be an 'uncertainty' discount if you ever tried to exercise those equal rights within China domestically. Now, in another offshore juridisdiction, this parity has been clarified beyond doubt:

So the shares are economically the same - but are they fungible?

At heart there are two key issues here: are all shares the same? And if they are, are they fungible? The second, and far more important, takeaway from the HK relisting prospectus was that it outlined a clear path to proving fungibility of the D-shares in another offshore jurisdiction. It is worth quoting from the prospectus, at length:

This reads like a long and convoluted process, to be fair, and in all honesty a D-share conversion to H-shares has never been done before (after all, there is only one D-share and that's Haier!). However, the essence of the process is not that different to other conversions of this type: you need to prove ownership (hence the letter proving title to the shares); you need exchange approval (in this case, the HKEX) as well as the company's approval; and then the share registrar needs to update the registries both in Germany and HK for the adjusted share counts. This seems fairly procedural - most of this kind of thing is par for the course for any decent custodian of a large financial institution.

The real risk in proving fungibility, then, is not the paperwork, it is really just one potential item in the above: will the HKEX/the company approve a mass migration of D-shares to H-shares? The company has responded to questions of this nature by saying 'we will not allow conversion now given the complexity and difficulties in processing'. However, this does not mean they will never allow such a move...and in fact as we shall see, there is an obvious ulterior motive in not allowing conversion now (which would clearly drive the arb spread to zero and push up the price of the D-shares) because their parent company, Haier Group, wants to buy a huge chunk of the German line!

The Haier Group D-share purchase announcement

The company put out a most intriguing press release on Dec 31st, which highlighted exactly what Haier Group is looking to do:

In other words, Haier's parent company is looking to purchase a minimum of ~9mm EUR of shares, and up to 123mm shares (2% of the pro forma shares, less the 57mm already bought in Sep19), entirely through the D-shares. There is no price limit set for the purchases, either. I believe Haier has ~6mos to complete this buying, and, per the company - they have not purchased any of these additional shares yet. If they were to complete this entire purchase, they would be acquiring ~57% of ALL D-shares not currently owned by the Haier parent. Obviously, this could not be accomplished at current prices...

Of course, there is no guarantee Haier parent co is able (or willing) to purchase any shares beyond the committed minimum of ~9mm EUR worth of shares. Still - this quite likely explains the reason why conversion/fungibility is not being pursued, immediately. Why would the company do this and immediately eliminate the discount for its parent? Obviously it wants to increase its exposure, and wants to do so at as cheap as possible a price - and given the size of the purchase, the only way they can possibly do this is by letting/making opportunistic investors (like us) think fungibility isn't possible at all. In fact, I fully expect the D-shares to be made fungible - if or when Haier parent co has acquired their stake, and/or of the discount doesn't close in some reasonable timeframe (maybe a year?).

But what if it's not fungible? Even then the relative discount is beyond extreme...

Of course, I could simply be wrong and the D-share may never be allowed to be fungible into the H-shares. But the beauty of this situation is that even in this apparently adverse case, I am getting into HSH at by far largest spread I have ever seen for a situation like this - that is, a non-fungible dual-listed company structure. You can read more about the history of DLCs here, but the long and short of it is there are very few of these types of situations left. The vast majority of them have been turned into single holding companies, with two listings (ie, that are completely fungible), and thus the discounts have basically all closed (this happened with Royal Dutch Shell; Investec; Carnival Cruises; Unilever, etc).

Today, there are really only two non-fungible DLCs of scale that I can find: Rio Tinto and BHP - both dual listed in the UK and Australia (ignore the US listings of HK companies, as those are all ADRs and thus completely fungible). Here is the spread for Rio Tinto going back 5 years - you can see the spread peaked temporarily at 30% during the height of COVID, but has basically been in a 10-20% range for this entire period, and is currently <15%:

The BHP spread tells a similar story: a 30% peak discount post COVID, punctuating a long stretch where the discount have traded as low at 5% and mostly in the 15% range. At the moment the discount in around 16-17%:

How should we think about RIO/BHP in relation to our subject, Haier? There are of course a myriad of reasons for why two economically-identical instruments could nonetheless trade at different prices, in the absence of fungibility (tax consequences for local investors; index make-up/differences; liquidity, etc). Of course, the Haier situation is NOT identical to BHP/RIO, and in a few important ways you would expect, ceteris paribus, a wider spread: BHP/RIO are in 'cleaner' geographies, and are more liquid in the 'junior' market (London); and they have also been listed/tradeable for much longer. But on the other hand, both RIO and BHP are definitively NOT fungible, and will never become so; on the other hand, Haier holds - even in the worst case - a decent possibility of being fungible in the future (and in my view the likelihood regarding fungibility is >50%). Also, we should remember that Haier is not that illiquid in Germany (recent volume is $10mm/day), and the HK line has a $30bn market cap today - in other words this is still a very large, reputable, international company, not some 'fly by night' local Chinese play that will remain uninvestable for offshore money. We should also consider that the German line only has a ~200-300mm EUR free float, so if any reasonably sized money wants to put on the spread, it could quickly tighten to levels much tighter than seen in BHP/RIO, based on supply/demand of the D-shares alone.

Putting it all together, IF fungibility is never proven out, I would expect the Haier spread to trade somewhat wider than other spreads of this ilk - but there is no reason to expect it to trade at 55% (the current level)! Even if the spread remarked to the recent wides seen in BHP/RIO - that is, 30% discount to the HK line - it would still imply a ~2.36 EUR stock price on the German line - good for 54% upside from current. If instead it traded at a more reasonable 20% discount - that is, wider than the BHP/RIO spreads are today but still within context - you would expect a price of up to 2.7 EUR - or 75% upside from current.

Why does this opportunity exist?

I have been scratching my head as to why this opportunity exists. Obviously it has moved a bit recently (since the HK listing brought it onto some radars), but the spread to the HK line - which has been rallying as well - has not tightened much at all (basically from the mid-60s% to mid-50s%). I think the current relative cheapness is a function of a number of factors:

- sell-side has only begun to initiate on Haier (in HK), and many notes don't even include the D-shares in the cap structure (eg Jefferies, one of the better Asian consumer coverages, doesn't even include the D-shares in their initiation note). As a result I doubt any fundamental buyers buying the H-shares today are truly aware the D-shares exist (and that they are economically identical to what they're buying in HK);

- the listing in HK happened on Dec 23, and the Haier Group purchase announcement happened on Dec 31 - hardly peak 'market viewing' time for buy- and sell-side alike;

- one (or more) legacy Chinese SoEs who supported the German listing in 2018 may be taking profits now that the stock is above IPO price;

- relative value accounts are fewer these days in Asia and the trade hasn't yet crossed global RV desks.

I believe many if not all of these are likely to be temporary headwinds. People are coming back to their desks after the holidays and this will jump off the page. Whilst of course not every fundamental buyer of the HK line will be able (or willing) to trade in Germany, the discrepancy in market cap - $30bn in HK, ~$500mm in Germany - is so staggering it will only take a very low single digit percentage of owners willing to trade liquidity for cheapness to close the spread (or a large part of it). Similarly, even if a large portion of the legacy Chinese holders are price insensitive sellers, this volume has 1) already largely been absorbed (given the increase in volumes above 1.05 in the last two weeks); and 2) this is likely to be matched, or more, by the buying from the Haier parent company.

I and/or others I advise hold a material investment in the issuer's securities.

Catalyst

Fundamental owners switching from H-share to D-shares

Haier Group parent buys shares in the market

Buy- and sell-side become aware this opportunity exists

| 1 show sort by |